Want to pass all three CFA® Program exams on your first try? Note these 3 pitfalls!

- Valerie Fawcett, CFA

- May 19, 2018

- 5 min read

Being able to pass all CFA® Program exams on your first attempt will make you stand out from other candidates statistically. Only 10% of total candidates can pass Level I exam in 2015, Level II exam in 2016 and Level III exam in 2017 in their first attempts. Therefore passing all three levels of the CFA® Program exam at one go is a good filter for hiring managers.

As someone who has passed all three levels at one sitting, and seeing where others have failed to do so, I’ve decided to pen down my experiences to share with young mentees. This is not meant to boost my ego, as certs and titles mean less to me now, as compared to work accomplishments and contributions to society. At this stage of my life, I pen down my experiences because I enjoy mentoring young people who are seeking guidance on front office roles in investments.

What are the odds of clearing all 3 exams in the shortest time?

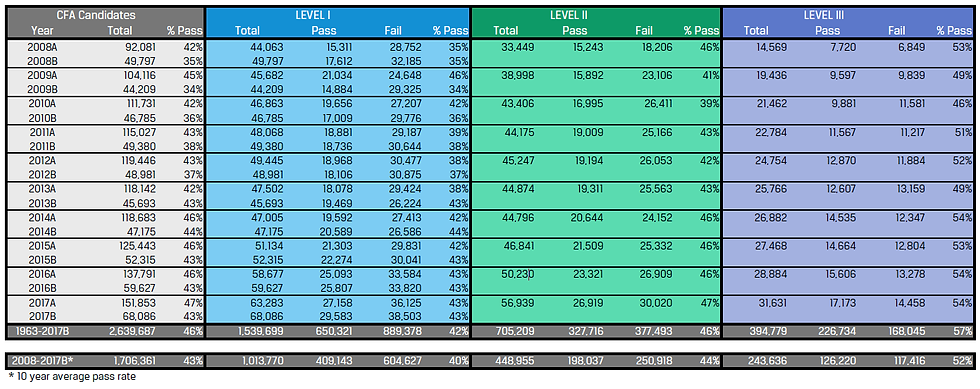

The passing rate for Level I exam has improved over the years based on statistics released from CFA Institute. However, I have little doubt that the statistics for passing all three levels at one sitting (for each level) has changed little.

CFA Institute provides a detailed passing rate for each level and each year. The average passing rates for Level I, Level II, and III over the past ten years are around 40%, 44% and 52% respectively.

Source: CFA Institute

For those who’ve set their mind on getting the CFA® charter in the shortest possible time, read on. In my experience, there are predominantly three pitfalls that hinder candidates from passing all three levels on their first try.

#Pitfall 1: Penny wise, Pound foolish on exam prep classes

If you think you are saving money by studying on your own, think again! You may save money, but are you saving time? There are some candidates who refuse to spend a dime on getting good course providers, even at Levels II and III. They think: “Oh, I can study on my own because my teachers already covered these in school”, or “I’m smart enough to figure these out on my own”.

If you have taken a peek at the Level II curriculum, you will know that it covers many complex topics, including pension accounting, valuing interest rate/currency swaps, and Black Scholes pricing for derivatives. Based on my experience, pure memorization does not work. Only those who can understand and apply these concepts during exams can they do the exams questions quickly and confidently.

After studying Level I of the CFA Program exam on my own, and factoring in the demands of my day-job, I decided to pay for classes from external providers for Levels II and III. The decision was a good one because the lecturers gave me more in-depth and real-life understanding of these subjects. Secondly, my course providers helped reinforce important concepts towards the exams and provided me with mock exam settings to help me prepare mentally and physically.

#Pitfall 2: Forgetting to calculate the BIG opportunity costs of failing

As the CFA Institute allows candidates to sit for the exams multiple times, this may lead some young people to have the false sense of security. The false sense of having all the time in the world.

“If I don’t pass it the first time, I can just retake it”.

Assuming you start taking your exams at age 25, and you take 5 years to finish all three levels of exams due to re-sits, you will be 30 years old by the time you finish. Unfortunately, 30 is the common cut-off age where most employers hire junior analysts or research associates.

If you passed all exams before your 30th birthday, you have a longer window of being hired. Why do I say this? Say you finished all the exams at age 27 but the job market for the front office is not good that year. You can stay on in your current job and look out for openings the next 2 years. But if you only finish your important exams at age 29, your window of opportunity becomes much shorter. If the job market does not pick up in 1-2 years, your chances of landing front office roles become much lower, assuming all other things are equal (i.e. other applicants have the same qualifications and experience as you).

In addition, job opportunities don’t always come right after your exams. As you are waiting for the opportunities, you still need to raise your proficiency in financial modeling, report writing, and networking, before getting connected to the right person and ultimately landing your desired job within the investment industry. This whole process of preparation can take a year or two.

Openings for front-office roles depend on a few market forces. First, the stock and bond markets go up and down. This affects the P&L of asset managers. If a particular asset market did poorly last year, they are not likely to hire within the next 6 months. If the reverse was true and the job market is good for 2-3 years, but you are not ‘ready’, you won’t be hired.

Most candidates do not factor this ‘loss of opportunities’ when wanting to pursue roles in the front office.

#Pitfall 3: Super Confident or Delusional?

Many young people take the exams when they already have a day-job. To squeeze time out on weekday nights and weekends to study is already a tall order. I cut my social life for 2.5 years because I knew that focus and discipline are essential traits to succeed in this industry.

Here is a snippet of a true story:

A young man named Bernard (not his real name) working in the same bank told me he was taking Level II exam, getting married, and changing career – all in the same year, while holding down his full-time job. When I advised him to stagger his goals because exam is much tougher than in Level I , he merely brushed it off, saying “don’t worry, I’ve got all these sorted out”.

“What a super confident – or else delusional young man,” I thought. The line between super confidence and delusion is sometimes very thin. One needs humility to acknowledge the difference. My intuition told me that it was the latter but I kept this to myself.

One year later, I asked Bernard how his preparations were for his Level III exams. He uncomfortably replied and said he was re-taking Level II. I consoled him, saying “Well, at least you got the wedding and job change out of the way, right?”

He grimaced for a while as if reflecting on some unpleasant memories, and sighed: “We had a big fight before the wedding and it almost didn’t happen.”

Many bright young people failed to distinguish matters that involve only themselves and matters that involve various stakeholders. An example of matters involving one person is taking exams. Students who recently graduated from University may find that taking the exams “a piece of cake” because they have taken exams all their school life. There are formulas to follow, books to “mug”, and test banks to try.

Planning a wedding and career change are matters that involve various parties. Events can sometimes be out of one’s control. Not factoring enough ‘buffer’ time to communicate with stakeholders (example your in-laws) and adapting to their sudden demands accordingly will drastically affect the outcomes of these goals.

*This post was first published here.

About the Author

Valerie Fawcett, CFA, is a sell-side research analyst at HSBC and Macquarie and a senior mentor at Springboard Talent Management. She attended CFA® Program exam prep courses here at AB Maximus and passed all three levels of exams on her first try.

Springboard Talent Management is a platform that nurtures young professionals intending to enter the investment industry. Springboard is proud to be a training partner of AB Maximus.

Comments